You can make health care better while earning an income from your gift.

Charitable Gift Annuities

Charitable Gift Annuities (CGAs) are a great way to support Spectrum Health while generating income for yourself and your family. Learn how these gifts allow you to achieve both of these goals.

You can make a substantial impact through Spectrum Health Foundation while you are receiving tax-favorable income for you, your spouse, and your children. Many supporters like charitable gift annuities because of their attractive payout rates and their significant impact.

Benefits to you include the following:

Payments can be made as you prefer on an annual, quarterly or monthly basis.

A portion of the payout will be tax-free.

You receive an immediate tax receipt for a portion of your gift.

Your gift passes to Spectrum Health Foundation outside of the estate process.

You create your legacy of caring for the people of West Michigan.

Charitable Remainder Trusts

Income for life for you and your family while reducing your taxes and supporting Spectrum Health.

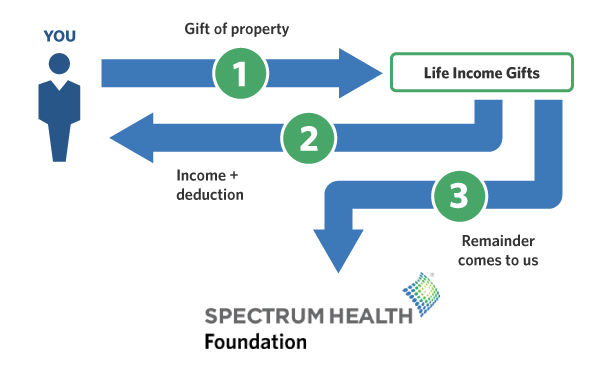

By using assets or cash to fund the trust, you receive income and you receive an income tax credit the year in which you transfer your assets. The remaining portion of the trust, after all payments have been made, comes to Spectrum Health Foundation.

Benefits to you include the following:

You receive income for life for you or your heirs.

You receive a charitable income tax credit for the charitable portion of the trust.

You create your legacy of making health care better.

Complimentary Planning Resources

Learn more about easy ways to leave a legacy with our free guides!

Your Giving Toolkit

Need assistance? We're here to help!

Kristin Long MPA, CFRE, CAP®

Lead Foundation Specialist

Spectrum Health Foundation

Helen DeVos Children's Hospital Foundation

616-486-6590

kristin.long@spectrumhealth.org

Shana Weemhoff

Senior Foundation Specialist

Spectrum Health Foundation

Helen DeVos Children's Hospital Foundation

616-391-3452

shana.weemhoff@spectrumhealth.org