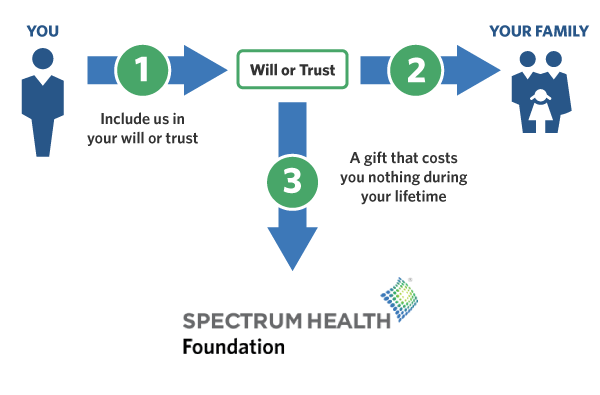

Gifts in a Will

A gift in your will is one of the easiest ways to create your legacy and a powerful and lasting statement about the importance of supporting our commitment to innovative healthcare solutions and wellness services.

A gift in your will is one of the easiest ways to create your legacy of compassion for patients receiving care in West Michigan.

Here are some benefits of including Spectrum Health Foundation in your will:

No Cost

Costs you nothing now to give in this way.

Flexible

You can alter your gift or change your mind at any time and for any reason.

Lasting Impact

Your gift will create your legacy of fostering health and wellness.

4 simple, "no-cost-now" ways to give in your will:

General Gift

Residual Gift

Specific Gift

Contingent Gift

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to Spectrum Health Foundation contingent upon the survival of your spouse and other loved ones.

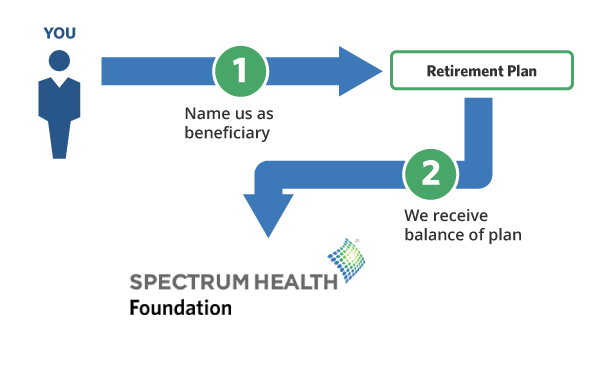

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in offering a full continuum of care to those in need through Spectrum Health Foundation — and it costs nothing now.

By naming Spectrum Health Foundation as a beneficiary of these assets, you will make a lasting impact on the region and beyond. Your gift impacts the young and the old through Spectrum Health and becomes your personal legacy to the world.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes on retirement assets

Reduce or avoid probate fees

No cost to you now to give

Create your legacy with Spectrum Health and supporting the people of West Michigan

To name Spectrum Health Foundation as a beneficiary of your retirement plan, contact your bank or insurance company to see whether a change of beneficiary form must be completed.

How to Change a Beneficiary Designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly:

Spectrum Health Foundation

Include our tax identification number:

#38-2752328

Save or submit your information online or return your Change of Beneficiary Form.

A Gift of Retirement Funds

You can simply name Spectrum Health Foundation as a beneficiary of your retirement plan to help people get the healthcare services they need.

CDs, bank accounts, brokerage accounts, and commercial annuities

This is one of the easiest gifts to give and one of the most useful in accomplishing what you want – helping people in need. The next time you visit your bank, you can name Spectrum Health Foundation (Tax ID #: 38-2752328) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward improving the health and wellness of our communities for generations to come.

Donor-Advised Fund (DAF) Residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name Spectrum Health Foundation as a “successor” of your account or a portion of your account value, you're creating a healthier future for the people of West Michigan.

Savings Bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since Spectrum Health Foundation is a tax-exempt institution, naming us as a beneficiary means that 100% of your gift will go toward supporting adults and children in need of care and services.

Complimentary Planning Resources

Learn more about easy ways to leave a legacy with our free guides!

Your Giving Toolkit

Need assistance? We're here to help!

Kristin Long MPA, CFRE, CAP®

Lead Foundation Specialist

Spectrum Health Foundation

Helen DeVos Children's Hospital Foundation

616-486-6590

kristin.long@spectrumhealth.org

Shana Weemhoff

Senior Foundation Specialist

Spectrum Health Foundation

Helen DeVos Children's Hospital Foundation

616-391-3452

shana.weemhoff@spectrumhealth.org